As a CEO of a crypto company, I think there hasn’t been a question I was asked more at networking events, or when people ask me what I do: “I’ve read, Bitcoin is nothing else than a Ponzi Scheme!”

Sounds so easy to respond to, doesn’t it? “Bitcoin isn’t a Ponzi Scheme because…” Right, why isn’t it??

If you throw this question at a Bitcoin super fan, you will mostly get meaningless answers without any substance such as:

- “Oh, look at this moron, he doesn’t understand Bitcoin otherwise, he wouldn’t even ask such a question!”, or:

- “Don’t listen to this person, he is a banker/journalist/scammer/(fill in your ad hominem attack role)!”, or:

- “No, Bitcoin is the Best Money!”, or:

- “No, but all the other Shitcoins (read: Altcoins) are and this person is just trying to shill his shitcoin!”, or:

- “How can it be a Ponzi Scheme if it has been around for 15 years?”, or:

- “If Bitcoin was a Ponzi Scheme, Gold would be one too!”, or:

- “Who cares if it is… Fiat Money is also a Ponzi Scheme, so?!”, etc.

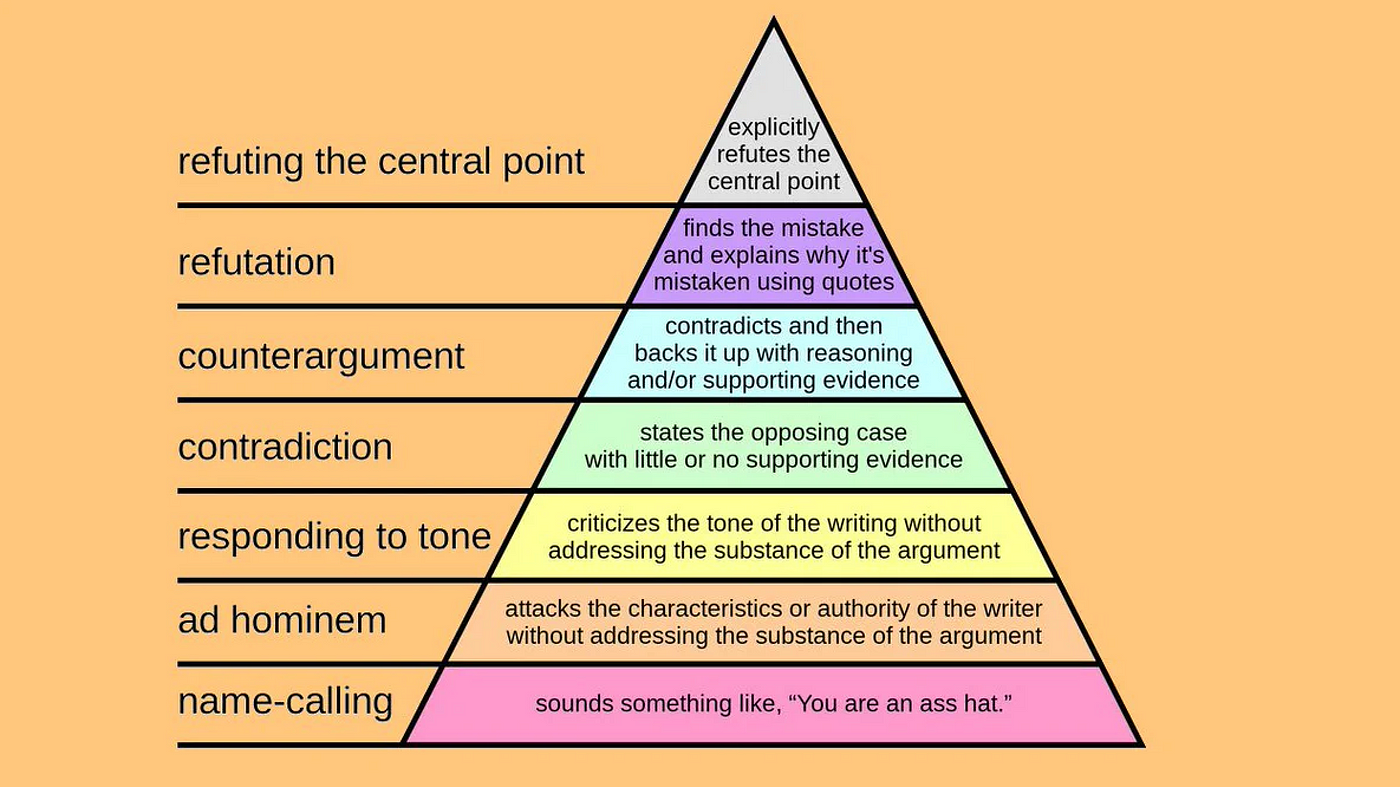

Some of these answers are plainly wrong, others don’t address the actual argument, while others simply try to divert. Looking at the pyramid of argumentation (the level of how to refute an argument), the way these people respond comes from them either not having a high IQ, them not understanding the actual subject, them not knowing how to explain the subject, or them knowing of being wrong, and an ad hominem attack or ridiculing the other person is the only way out for them.

In this article, I want to admit that the way Bitcoin is set up and pushed by many fans, it is indeed a Ponzi Scheme. However, I also want to explain how we as an industry can be better and make it not be one!

So, what is the actual refutation to Bitcoin potentially being a Ponzi Scheme… and if it is one, how can we fix it? Let’s first define what a Ponzi Scheme is: Named after Charles Ponzi, a Ponzi scheme is a fraudulent investment scheme that operates by using funds from new investors to pay returns to earlier investors, rather than generating legitimate profits from actual investment activities. This creates the illusion of a successful and profitable investment, enticing more people to invest. However, as the scheme relies on a continuous influx of new investors to pay returns, it eventually collapses when there are not enough new investors to sustain the payouts. This leads to significant financial losses for those involved, except for the initial orchestrators of the scheme who may have already profited.

So, it all centers around the “actual investment activities” and not just paying off earlier investors with your new investment. In an investment into a Business, the question is, will the investment be used for the business to generate more profits. In an investment into a non-Business, like Bitcoin, the question is, whatever you are buying, what can you use it for. For example, if we all invested in Oil, it would be difficult to argue that this is a Ponzi Scheme because in the worst case, we can always use the oil. We could argue we overpaid, but it definitely would have NOT been a Ponzi Scheme. The same is the case when investing in a Business. The Business could fail, and the money is gone, but it would have NOT been a Ponzi Scheme.

In a Ponzi Scheme, there are ALWAYS people who lose. Aka, it is a net-zero sum game. Every dollar someone wins, is a dollar someone else loses. In a proper business, it is always positive sum, as actual value is created. The way the value is created, is not by new investors, but by the business itself. It doesn’t require new money (aka make these people lose) to pay off old money (aka make these people win). It just requires the business to be useful. The same applies to commodities or precious metals. Sure, if you buy Oil or Gold from someone, you pay this person money (you lose at this moment and the other person wins), but maybe you didn’t buy the Oil or the Gold as an investment. You actually wanted to use it. Something’s utility in the investment market can be seen easiest, if you imagine it not being able to be traded, aka removing the price. If a stock is not traded, you still have the right to the underlying assets and future cashflows. If they don’t come, you lose your investment. If they come, you profit. With commodities like Oil, Rare Earths, etc. you can always put these things to use. Even Gold, is used for Industrial Use, and if you were to get kilos of Gold, but would not be allowed to ever sell it, you could still turn it into beautiful jewelry.

How about Bitcoin? The biggest challenge for Bitcoin in this regard is that you can’t use Bitcoin for anything. Since it exists only digitally, it has no application in the physical world directly. It can’t be used to build anything. You can’t use it for anything like you would use Oil or Rare Earths. There is absolutely nothing priced in Bitcoin, because all the stores accepting Bitcoin actually accept dollars, so this is nothing else than betting on price and not actual utility. Your car doesn’t care about the oil price. It just wants a liter of fuel for 10k of driving. No f-s given about the oil price. How many points of acceptances for bitcoin, or presidential candidates who take bitcoin for donations, or exchanges, or Bitcoin business, don’t care, if the Bitcoin price is 1 USD, 10,000 USD or 1 Million USD? ALL OF THEM. AKA: Zero utility apart from Price.

In Bitcoin, there is this famous saying: “We all gonna make it” or WAGMI. But actually, looking at this, it is an entire lie. The early investors are going to make it, while the newer ones can only make it, if they also find people who buy Bitcoin from them, as otherwise, there is nothing how they can use it. So, actually, it should be: “WANGMI… We all NOT gonna make it!”

How is this different to Altcoins? Most altcoins, especially the smart contract platforms, actually have utility on chain. Coins like Ethereum, DeFiChain, Solana, Polkadot, etc. all have native utility for Decentralized Finance, NFTs, etc. You need the coin for consensus and voting, you need it as collateral, you need it for decentralized exchanges, you need it for tokenization, you need it for gas fees like in a car, and much, much more. So, if the market price for ETH, DFI, SOL or DOT would suddenly disappear, the blockchain ecosystem itself wouldn’t even know or wouldn’t even car. Just like a car doesn’t give a f**k about what the fuel costs… it will eat the same number of liters, no matter what.

If we look at the typical comments from before, we can now answer them in an easy fashion:

- “Oh, look at this moron, he doesn’t understand Bitcoin!” -> Ad Hominem without actually answering anything

- “Don’t listen to this person, he is a banker/journalist/scammer/(fill in your ad hominem attack role)!” -> Ad Hominem without actually answering anything

- “No, Bitcoin is the Best Money!” -> Contradiction without actually explaining what “Best Money” is, why Bitcoin should be the best money, etc.

- “No, but all the other Shitcoins (read: Altcoins) are and you shilling a shitcoin is just trying to detract attention away form Bitcoin!” -> Trying to deflect while actually being wrong. Most Altcoins have strong utility.

- “How can it be a Ponzi Scheme if it has been around for 15 years?” -> Trying to deflect while forgetting, that a Ponzi Scheme can last for decades. For example, Bernie Madoff’s lasted for almost 20 years and probably would have lasted even longer had the SEC not started to investigate.

- “If Bitcoin was a Ponzi Scheme, Gold would be one too!” etc. -> -> Trying to deflect while actually being wrong. Gold actually has utility.

- “Who cares if it is… Fiat Money is also a Ponzi Scheme, so?!” -> Trying to deflect with something that is irrelevant. Fiat is indeed a Ponzi Scheme, but the reason, Fiat Money lasts so long, is the name itself: The government says “It shall be” and puts its entire military behind it. This also explains, why the US has been fighting every single war they have been fighting over the past 20 years: to support the dollar does not lose its global reserve status.

If you accept, that if Bitcoin doesn’t change going forward, it would be a pure Ponzi Scheme, you also understand the current approach by many bitcoin hardliners, is sadly quite destructive:

- Even though past performance says nothing about future performance, a huge deal is made about the price movement of the very early years. However, since the time that over 90% of all bitcoin people came into the space (after 2017), basically no returns were made, which is highlighted by the average bitcoin investment being down.

- All focus is spent on recruiting more money. Nothing is done to make Bitcoin useful itself. Actually, the exact opposite, some people say nothing should change. If no new money could enter the system, Bitcoin would be dead. In any smart contract altcoin, the coin would still be used for the protocol.

- People like Michael Saylor are being put on a pedestool to attract even more money. Fake Models like the Stock to Flow model are being created, to give the impression we could know where the price goes.

- Politicians, sometime more corrupt than others, prey on this community. The community in return, uses any possibility to build up the image of people buying Bitcoin.

- Countries like El Salvador are being used as an example of Bitcoin adoption. When data is very clear, that basically none of that is happening in El Salvador, and the entire move functions more like a marketing move for El Salvador.

- Pushing for Institutional Adoption and a Bitcoin Spot ETF goes against everything, Satoshi pushed for: Wallstreet. Now, Bitcoin Laser Eye Fans are celebrating it, as it “pumps their bags”. Zero additional value is being added, though.

- Governments Mining Bitcoin is being sold as something valuable to Bitcoin, when it has absolutely nothing to do with Bitcoin. It is a pure Fiat Transaction: Use USD to buy Computers, use Computers to mine Bitcoin, sell those Bitcoin right away at a profit. If you have access to cheap electricity and cheap capital, mining Bitcoin is a no-brainer.

- Bitcoin is NOT “the Best Money” just because people say so without giving any bit of proof. It is not an inflation hedge as we have seen over the past years. So, all that is left, is motivating people to stack more sats, as this is the source for everything: more new money, so the old money can cash out.

So, I know, the facts I present here, don’t look rosy for Bitcoin right now, and if that were it, I would wholeheartedly say that Bitcoin is a Ponzi Scheme while most Altcoins aren’t. But how do we fix it? We do so by making Bitcoin useful! Bitcoin is programmable, so we can give it utility, by building things on top:

- In the past, Omnilayer allowed for applications

- Right now with Taproot and Ordinals, we have more opportunities.

- Drivechains (sidechains) are aiming to bring utility to Bitcoin

- Projects like Stacks, DeFiChain and others, who try to build around Bitcoin, are bringing utility to Bitcoin

- Wrapping Bitcoin and bringing it to smart contract platforms, is making Bitcoin useful, though centralized

Why do many Bitcoin Hardliners oppose the above? Two main reasons:

- some actually know Bitcoin is a Ponzi Scheme, and understand that complexity is the enemy of execution. The easier you keep the message and the scheme, the easier it is to attract new money. More Building on top, increases complexity, which could bring failure.

- the main firm behind Bitcoin “Blockstream”, has very clear interests with Lightning, etc. and so far, everything that was built that hasn’t benefited them directly, has been attacked by them. Sadly, their influence is massive.

So, while the situation is dire for Bitcoin, it is not lost. Nevertheless, if this works out, then WAGMI. And if that is what you invest for with Bitcoin, then we are fully aligned. It is, for example, why my organization Cake Group holds Bitcoin on its balance sheet or why we invest in projects like DeFiChain or Ordinals that bring utility to Bitcoin. However, if nothing changes, other than a Bitcoin Spot ETF, with a rising BTC price, I will use this moment to shed off my last bitcoins and never look back.

I am hopeful things will turn out great!

Let me know your thoughts.

Julian