If you’ve been investing in crypto for some time now, chances are you’re very much aware of how unpredictable the world of cryptocurrency can be. Moreover, if you’ve been following the news, you’ll also agree that this is particularly evident lately.

Bitcoin, the flagship cryptocurrency, has experienced a significant decline to almost $15,000 in November 2022 since hitting its all-time high of nearly $65K in mid-April 2021, only to rally to US$28K in March 2023.

In such an environment, it is easy to get caught up in the hype and lose sight of the bigger picture. However, it is important to step back and take a rational approach to the current state of the market, especially when the fear and greed index is at a very high level.

Here are ten contrarian viewpoints to help calm your nerves and provide you with a contrarian perspective to what many people may say on Cryptotwitter or -reddit.

1. Max Pain Theory

The Max Pain theory is a contrarian view that suggests the price of an asset will rise to a level that causes the maximum amount of pain for the largest number of investors, before crashing. However, this theory is not based on any empirical evidence and just one of many theories that attempt to explain the ups and downs of the cryptocurrency market. It is critical to remember the market can move in any direction at any time, and that no one theory can predict the future.

2. Crypto Has Many Fundamental Problems with Negative Price Drivers

Despite the hype surrounding cryptocurrency, there are still many fundamental problems that need addressing. From security issues to regulatory concerns, there are many negative price drivers influencing market volatility. A Bitcoin ETF, a downfall of DCG, etc. are all potential issues here.

3. Potential False Narrative of 4-Year Cycles

The 4-year cycle narrative is common in the cryptocurrency world. This theory suggests there is a predictable pattern to the market, with prices rising and falling in a predictable cycle every four years. However, this theory is based on correlation and not causation, and there is no evidence to suggest the market will continue to follow this pattern in the future. It is important to take a rational approach to the market and not get swept up in hype and speculation.

4. Crypto Crackdown & Taxation Persists

The current administration has made it clear that it intends to crack down on cryptocurrency and impose new regulations and taxes on the industry.

5. The Wider Economy Is Broken

The general economy is in a precarious state, with many experts warning of an impending recession. Real estate prices have not yet collapsed, but many indicators are suggesting a collapse may be imminent. In addition, the fundamentals of the economy are broken due to the massive amounts of money printing between 2020 and 2021.

6. Data Proves That Crypto Is Pumping Because Of Stablecoin Selling

The recent surge in cryptocurrency prices has been attributed to outside money buying into the market. However, data suggests that the majority of the price increase is due to stablecoin selling, rather than new money entering the market. It is important to take a rational approach to investing and not get swept up in hype and speculation.

7. Retail Is Falling for Fake US$200B Liquidity

When the US Treasury has announced a backstop to bank deposits, 200 billion USD was added to the FED balance sheet. Investors instantly drew comparisons to 2020 and 2021, but this liquidity is very different from injecting it directly into the markets by buying bonds. As such, investors should be cautious when interpreting a FED balance sheet increase as an indicator to go risk-on.

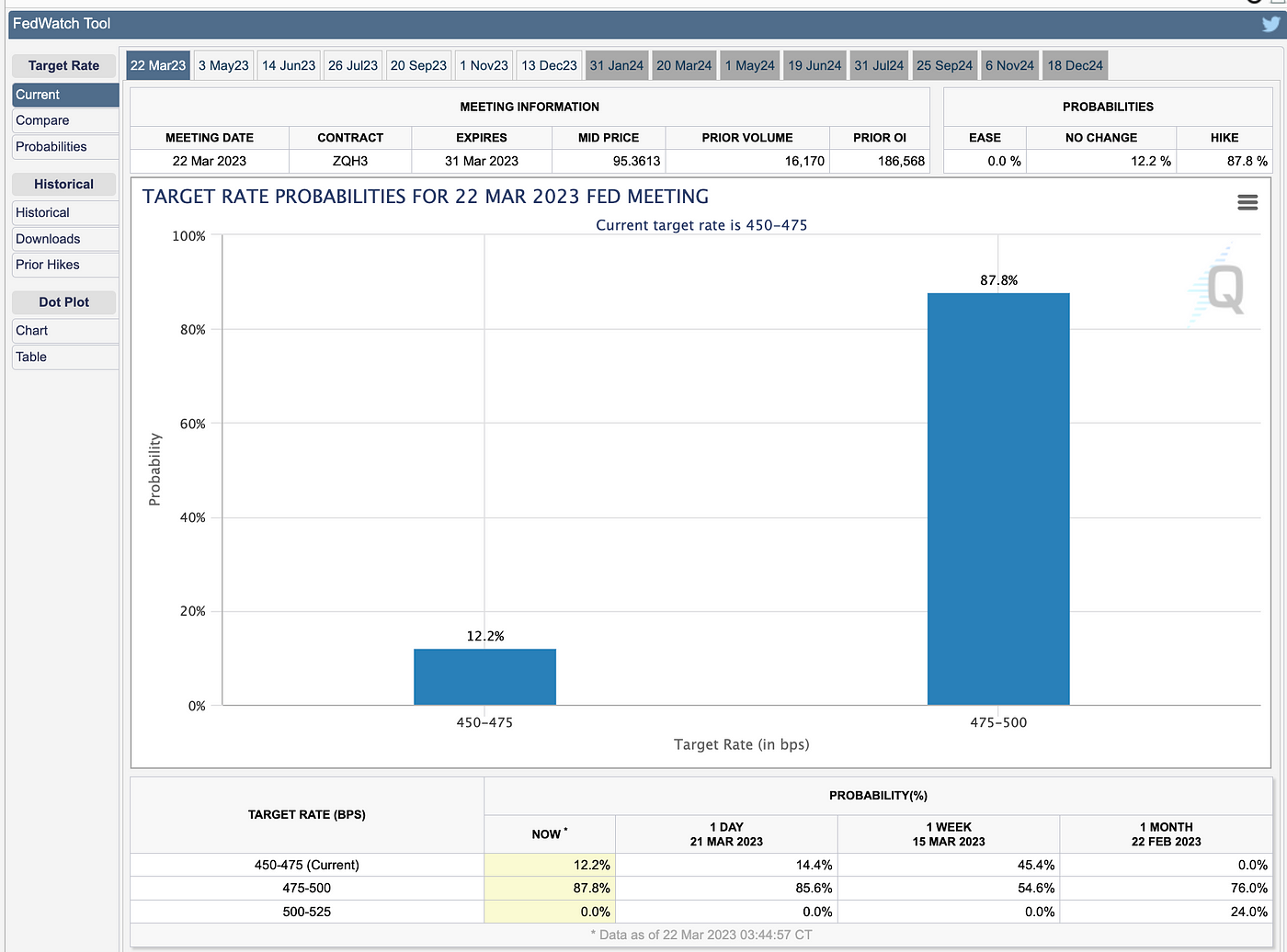

8. Retail Has False Hope On Fed

The US Federal Reserve has been closely scrutinized by crypto investors lately, as many see its monetary policy decisions having a significant impact on the crypto market. While some retail investors may be hoping for a shift in the Fed’s stance towards monetary policy, most institutional investors believe the Fed will continue with its current plans. Therefore, investors should not base their crypto investment decisions solely on the assumption that the Fed will change course.

9. False Narrative of Crypto “Unbanking People”

One of the most popular narratives surrounding cryptocurrencies is that they will “unbank” the world by providing financial services to the unbanked and underbanked populations. While this may be true in some cases, it’s important to remember the struggles of traditional banks and the rise of technology are not necessarily the driving forces behind the growth of cryptocurrencies. Cryptocurrencies should be treated as a new asset class offering unique features and benefits. Therefore, investors should focus on the fundamentals of individual cryptocurrencies, rather than on the broader macroeconomic forces that may be driving the market. Right now, it is not only crypto going up, but also other risk-on assets just like companies in the NASDAQ… which would make no sense in that narrative, especially, with its bottom being in on March 13th and only rising since then.

10. Data Proves Institutions Are Moving Money Out Of Crypto Right Now

Finally, it’s worth noting that while retail investors may be driving much of the recent crypto market rally, institutions are taking a more cautious approach. In fact, recent data suggests institutions have been net sellers of cryptocurrencies in recent weeks, rather than net buyers. It’s important to remember institutions have a longer investment horizon compared to retail investors, so, it’s possible institutions are simply waiting for more favorable market conditions before re-entering the market.

Calm Minds Prevail

All in all, I am very bullish on crypto in the mid- to long-term. It just makes ZERO sense to me right now to panic into the markets at this stage. When dealing with volatile times and markets, it is critical for investors to be rational and disciplined. Instead of being swayed by hype or emotions, decisions should be based on facts and data. If you’re looking for a strategy that works well in such uncertain times, dollar cost averaging (DCA) is a strategy to be considered. It has definitely worked for me so far.

Finally, if you’re looking for the perfect platform to generate cash flow on your crypto, please visit www.cakedefi.com. Our platform is secure, transparent, easy-to-use and offers stable rewards. In fact, we just launched cakeELITE — an exclusive membership plan that allows serious crypto investors to generate more rewards and enjoy benefits.

I invite you to check out our platform and our amazing services. That’s all for now. Until next time -stay safe!

Julian Hosp

Cake DeFi CEO and Co-Founder